Nso stock options tax calculator

Ways to check pension status on EPFO portal The following system is adopted for the allotment of 12 digits PPO numbers. The double-digit rise in the GVA in Q1 FY2023 was led by a rebound in services activity on a low base with two of the three sub-sectors displaying a resounding YoY expansion in excess of 25 percent.

How Stock Options Are Taxed Carta

If no tax is being withheld please provide us with the facts in writing and include a copy of your most recent W-2 or paystub and submit this to the Ohio Department of Taxation Employer Withholding.

. The Employees Provident Fund Organisation EPFO sees a case for substantially increasing the retirement age and aligning it with life expectancy. Intraday data delayed at least 15 minutes or per exchange requirements. CEA Limits and Taxation.

Labour force participation rate is defined as the section of working population in the age group of 16-64 in the economy currently employed or seeking employment. Stock Option Exit Calculator. Decide whether to exercise your stock options now or later.

Income Tax Calculator Emergency Fund Calculator LOANS CREDIT CARDS Home Car Loan Calculator. Stock Index FO Trading Calls Market Analysis. Learn how Incentive Stock Options are taxed and how to calculate your Alternative Minimum Tax AMT resulting from an ISO exercise using our AMT Calculator.

Access real-time data charts analytics and news from anywhere at anytime. Incentive stock options ISO and employee stock purchase plans. If no tax is being withheld please provide us with the facts in writing and include a copy of your most recent W-2 or paystub and submit this to the Ohio Department of Taxation Employer Withholding.

53 Is Ohio income tax withholding required on qualified stock options - eg. GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path. Must contain at least 4 different symbols.

Stock Ideas Multibaggers Insights. Stock quotes reflect trades reported through Nasdaq only. Go ahead and try out our simple AMT tax calculator that only needs a few inputs number of options strike price fair market value income level state and marriage status.

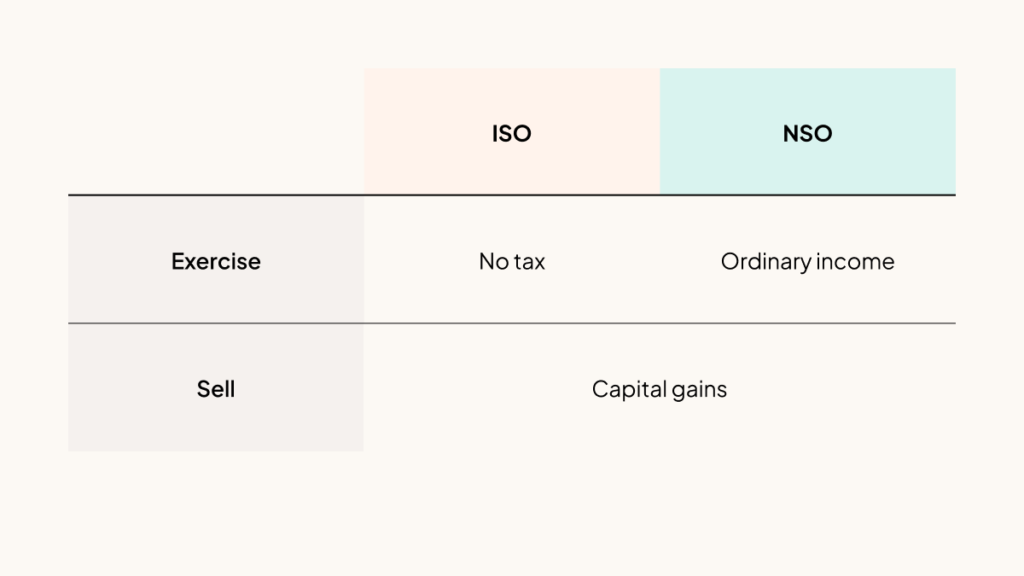

In this article youll learn the tax implications of exercising non-qualified stock options. Incentive stock options ISO and employee stock purchase plans. Companies can issue whats called non-qualified stock options also known as NSO.

In each PPO the first five digits indicate the code number of PPO Issuing Authority next two digits indicate the year of issue and after this the four digits indicate the sequential number of the PPO while the last digit is a check digit for the purpose of. Stock Option Tax Calculator. Rental price 70 per night.

AICC rejects demand to make electoral rolls public. Get our latest economic research delivered to your. Calculate the costs to exercise your stock options - including taxes.

Since the spread on an NSO is treated as ordinary income when you exercise it makes a lot of sense to sell immediately to ensure that youll have the funds you need to pay the taxes. People who are still undergoing studies housewives and persons above the age of 64 are not reckoned in the labour force. The data would.

To further advance the cause of literacy especially among the backward states Indias Income Tax department provides a number of tax breaks collectively known as Children Education Allowance or CEA. The Singapore Exchanges Nifty futures traded 74 points or 042 lower at 17670 indicating that the stock market may have a start in red to the week. Israeli spyware firm NSO Group said on Sunday its Chief Executive Shalev Hulio is stepping down with immediate effect with Chief Operating Officer Yaron Shohat appointed to oversee a.

Exercise incentive stock options without paying the alternative minimum tax. The labour force participation rate is the. There are two types of taxes you need to keep in mind when exercising options.

Insights Home Subscribe to Research. Evaluate your cleared margin requirements using our interactive margin calculator. If you exercise a non-statutory option for IBM at 150share and the current market value is 160share youll pay tax on the 10share difference.

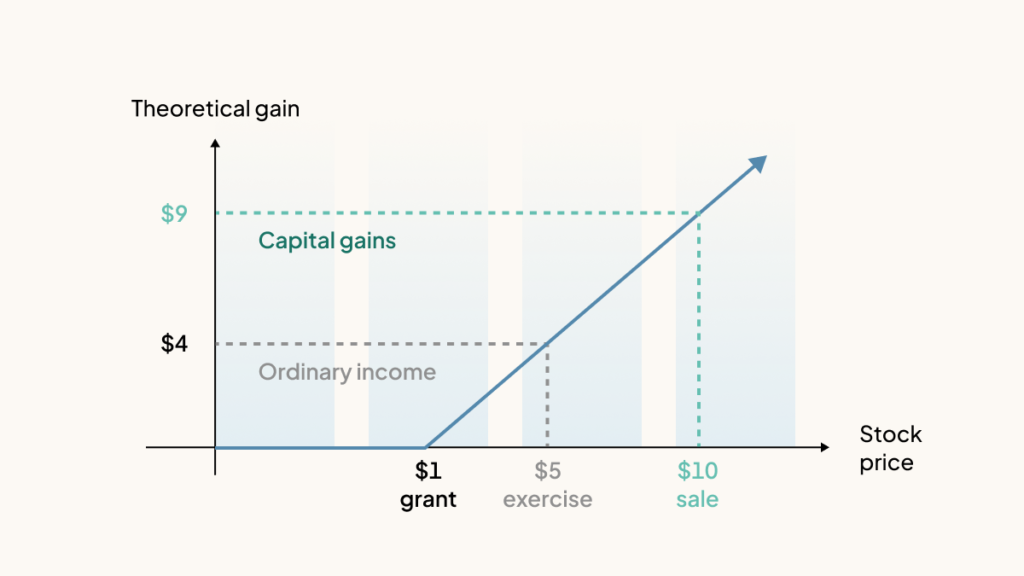

The unemployment rate for persons aged 15 years and above in urban areas dipped to 76 per cent during April-June 2022 from 126 per cent a year ago the National Statistical Office NSO said on. This data was made publicly available by the NSO in September 2020 on the occasion of World Literacy Day. Ordinary income tax and capital gains tax.

With an NSO the difference between the exercise price and the fair market value is subject to ordinary income the year you exercise the option. See what your stock options could be worth. AICC rejects demand to make electoral rolls public.

Stream live futures and options market data directly from CME Group. ASCII characters only characters found on a standard US keyboard. Incentive stock options ISOs are taxed differently than nonqualified stock options NSOs.

If youre an executive some of the options you receive from your employer may be Non-qualified Stock Options. The following 10 stocks may be the most. Income Tax Calculator Emergency Fund Calculator LOANS CREDIT CARDS Home Car Loan Calculator.

In our continuing example your theoretical gain is zero when the stock price is 1 or lowerbecause your strike price. Stock Index FO Trading Calls Market Analysis. Real-time last sale data for US.

When you sell the shares any increase in the sales price is subject to capital gains tax. Stock Ideas Multibaggers Insights. However when you exercise a non-statutory stock option NSO youre liable for ordinary income tax on the difference between the price you paid for the stock and the current fair market value.

Nonqualified stock options have a pretty straightforward tax calculation eventually well build a calculator for you to use. 6 to 30 characters long. Get a breakdown of your new hires total tax liability and take-home pay.

Since the company doesnt have a direct employment. 53 Is Ohio income tax withholding required on qualified stock options - eg. These are options that dont qualify for the more-favorable tax treatment given to Incentive Stock Options.

Navigate the statutory common and competitive benefits in each market. Indias GDP data for the April-June quarter of this fiscal year gauging the countrys economic growth will be released by the National Statistical Office NSO later this evening.

About Ebsa United States Department Of Labor Retirement Calculator Retirement Calculator Department Financial Planning

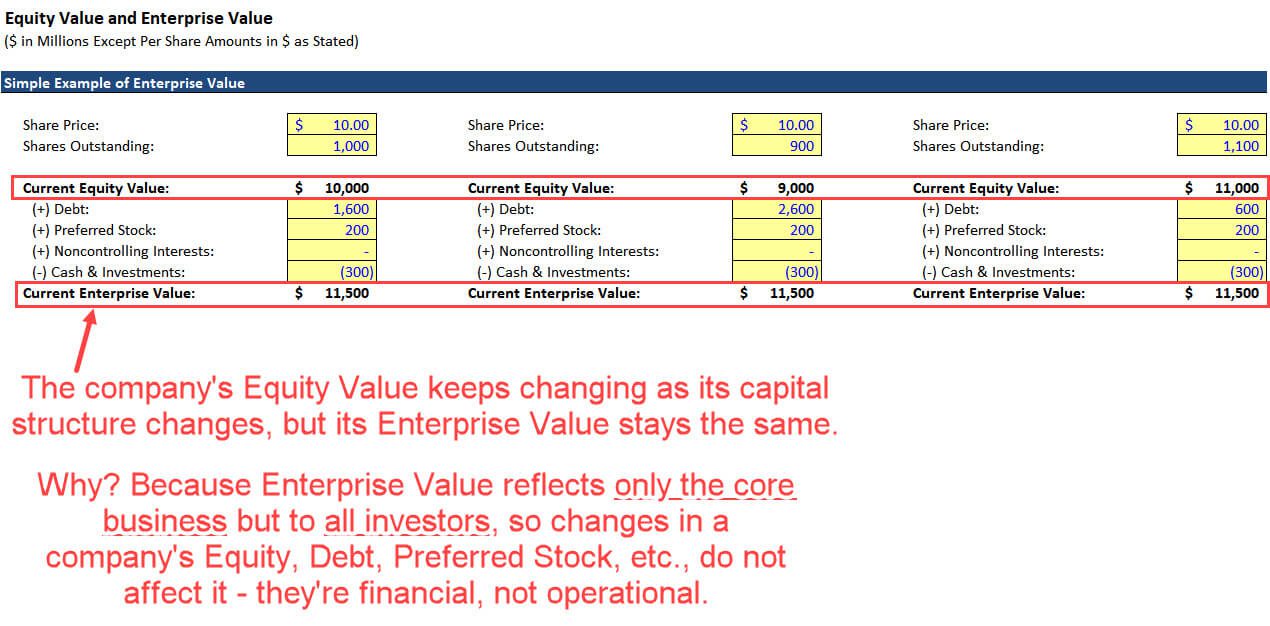

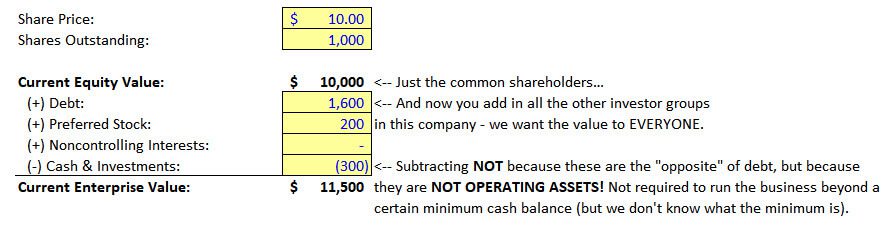

How To Calculate Enterprise Value 3 Excel Examples Video

Rsu Calculator Projecting Your Grant S Future Value

Retirement Withdrawal Calculator For Excel

Stock Options For Startups Founders Board Members Isos Vs Nsos

How To Calculate Enterprise Value 3 Excel Examples Video

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

Finance Float Calculator Floating Stock Calculator The Financial Falconet

How Stock Options Are Taxed Carta

Isos The Importance Of 83 B Pt 3 Tax Planning Insights Wrp

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

Employee Stock Options Esos A Complete Guide

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

Accounting For Stock Compensation Ipohub

Nonqualified Stock Option Nso Tax Calculator Equity Ftw

Non Qualified Stock Options Nsos

Restricted Stock Units Jane Financial

How To Calculate Enterprise Value 3 Excel Examples Video